Analysis of EURUSD, GBPUSD, XAUUSD: What You Should Know

- Home

- Our Latest News

- Analysis of EURUSD, GBPUSD, XAUUSD: What You Should Know

With a daily turnover of more than $6 trillion, the forex market gives rise to some of the best trading opportunities daily. Most of the trading opportunities crop around EURUSD and GBPUSD currency pairs, with Gold accounting for a significant amount of market orders. The trio stands out partly because the U.S. dollar, the global currency, the EUR, and the GBP represent some of the world’s biggest economies. On the other hand, gold acts as a safe-haven and a hedge against inflation in addition to being a precious metal.

EURUSD Analysis

Understanding the EURUSD Pair

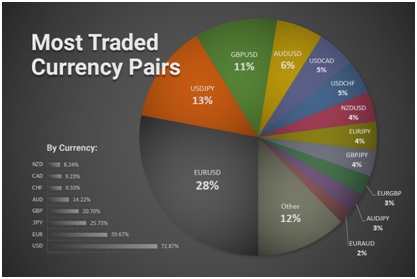

The EURUSD is the most traded currency pair in the forex markets, accounting for nearly 28% of the total traded volume daily. The daily average trading volume on the currency pair is almost $1.1 trillion.

Source: Fxssi.com

The popularity of the EURUSD in the forex market stems from the Euro, the official currency of the European Union and one of the biggest trading blocks. The trading block yields economic clout and is second to none comprising 19 countries. Additionally, the Euro is the second largest reserve currency accounting for 20% of the global reserves by volume.

Additionally, the pair contains the USD, the global reserve currency, and the most sought-after currency. The U.S. dollar is also the official currency of the largest economy in the world. Consequently, combining the currencies of two of the biggest economies in the world will always elicit interest from different market players.

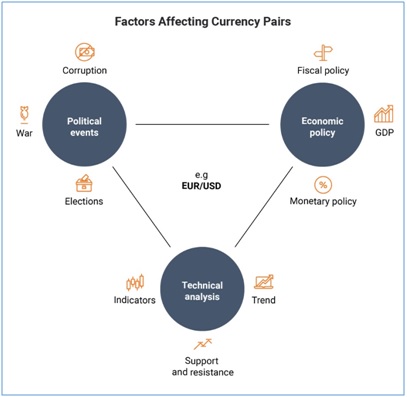

Factors that affect EURUSD Price action in Forex

Monetary Policy

Monetary policies implemented by the European Central Bank (ECB) and the U.S. Federal Reserve (FED) influence the strength of the two currencies relative to one another, consequently affecting the exchange rate. In addition, every month, the ECB and the FED release reports touching on interest rates and the economic outlook in the two economic blocks.

Retail and institutional traders examine the reports to gauge the two economies’ health and decide how to trade the currency pair. For instance, whenever the FED raises interest rates on a booming U.S. economy, the dollar strengthens across the board, consequently causing a euro depreciation.

Source: Dailyfx.com

Similarly, whenever the ECB raises interest rates buoyed by the block’s economic outlook, the Euro strengthens against the U.S. dollar. Consequently, the EURUSD exchange rate in the forex market tends to increase.

Market participants tend to follow every meeting of the two central banks. Therefore, speeches by the respective governors and officials also heavily sway EURUSD price action in the forex market.

Economic Reports

In addition to monetary policy by the two central banks, traders also closely watch economic reports from Europe and the U.S. The outcome of the reports and how the traders interpret them influence EURUSD sentiments significantly, consequently, price action in the market

Consumer price index (CPI) out of Europe and the U.S. is one of the most important economic reports market participants look out for every month. The report paints a picture of inflation levels in the two economies, which often influence monetary policies by the two central banks.

Whenever the CPI reading in the U.S. increases significantly, it signals runaway inflation, prompting immediate action from the FED. The FED might resort to hiking interest rates in a bid to reduce money in supply. The FED hiking interest rates often trigger dollar strength causing the EURUSD price in the forex market to decline.

In addition to the CPI, Gross Domestic Data is another vital data to watch closely while trading the EURUSD pair. The GDP triggers wild swings whenever it hits the wire as it highlights the health of the two economies.

The Non-Farm Payroll is arguably one of the biggest economic releases influencing EURUSD price action. The report affirms the health of the U.S. labor market and is known to be a key consideration for monetary policy decisions.

Other economic data to watch out for when trading the EURUSD include The Purchasing Manager Index, the Balance of payments, the trader balance, and the current account influence the pairs’ price action.

Political Instability

Geopolitical tensions in Europe, the U.S., or the rest of the world can significantly impact the EURUSD price action. For example, elections in European countries with some of the biggest economies, such as France and Germany, are closely watched. Likewise, elections in the U.S. are also closely watched, which often ends up with a significant impact on the kind of policies that affect dollar strength.

The dollar, a global reserve currency, also comes under the spotlight whenever geopolitical tensions escalate. For example, tensions between the U.S., China, and Russia tend to fuel fear in the market, forcing traders to rush to the dollar as a safe haven, consequently affecting EURUSD price action.

Top Strategies to Trade the EURUSD

While trading the EURUSD pair, some strategies tend to yield some of the best results, given how liquid the pair is.

Buy the Pull Back Sell the Pull Back

While the EURUSD is one of the most traded currency pairs, it tends to generate strong trends whenever it moves up or down. Consequently, whenever the EURUSD price is moving up in the price chart, the best way would be to wait for a pullback to buy low.

The EUR USD trending up often signal EUR strength against the dollar, providing an opportunity to profit from buy positions. Similarly, whenever the EURUSD price is edging lower, signaling the Dollar’s strength against the Euro, the ideal play would be to wait for the price to pull back after a significant move lower to open a short position.

Buy and Sell Breakouts

The EURUSD is not always trending. There come periods of consolidation whereby the pair trades in tight ranges struggling to register any new highs or lows. During periods of consolidation, it is essential to wait for potential breakouts.

Source: Tradingview.com

For instance, if the initial trend was bullish and the pair resorts to trading in a range, the prospect of the pair breaking to the upside is usually high. Whenever a breakout starts after long periods of consolidation, it would be wise to enter trades in the direction of the breakouts.

Range Trading

Additionally, whenever the EURUSD is trading in a range struggling to register new highs or lows, the ideal play would be to identify support and resistance levels. Afterward, simply wait to open a sell position at the resistance level and exit at the support level. Similarly, enter a buy position at the support level and exit at the resistance level.

Source: Tradingview.com

The buying and selling at the support and resistance level can continue until prices break out of the range.

The Best Time to Trade the EURUSD Pair

The EURUSD pair generates some of the best trading opportunities during specific times of the day. The pair is active and volatile when the European markets are opened as European banks are up and running. The economic releases out of Europe during this time also influenced traders’ sentiments, consequently triggering significant price swings.

Whenever the London and the New York sessions overlap, some of the best trading opportunities for trading the EURUSD also crop up due to the increased number of market participants. Additionally, the U.S. dollar is usually the center of attention given the economic releases out of the U.S. as well as speeches from the FED officials.

GBPUSD Analysis

GBPUSD is the third most popular and traded currency pair in the market; The pair accounts for about 11% of the total traded volume on any given day. Moreover, the pair attracts a daily average traded volume of nearly $400 billion, which is significant for traders looking to profit from significant price swings in the market.

Its popularity stems from the pair being a combination of the GBP, the official currency of the U.K. and one of the biggest economies in the world. The U.S. dollar, on the other hand, is a global reserve currency representing the largest economy in the world.

Factors That Drive GBPUSD Price Action

Institutions and Personalities

The GBPUSD price action often comes down to monetary policies implemented by the Bank of England and the U.S. Federal Reserve. This is because the two central banks play a pivotal role in regulating monetary policies in the U.K. and the U.S., which affect the pound and the U.S. dollar sentiments in the forex market.

The monetary policies by the FED on inflation and interest rates have a huge bearing on dollar sentiments, consequently, its strength, which ends up influencing the GBPUSD exchange rate. Furthermore, the FED hiking interest rates, as the Bank of England refrains, tends to trigger dollar strength as high-interest rates make a currency attractive overseas, thus fueling its demand.

Source: Forextraininggroup.com

Similarly, whenever the Bank of England cuts interest rates owing to concern about the U.K. economy, the pound tends to weaken, resulting in the exchange rate depreciation. Therefore, the monetary policies imposed by the two central banks influence traders’ sentiments on the two currencies, thus affecting their price action.

Economic Data

While trading the GBPUSD, it is vital to watch economic data from the United Kingdom and the U.S. as they influence traders’ sentiments consequently, the pair’s price action. Furthermore, inflation data are closely watched by the Bank of England and the FED and go a long way in influencing interest rate decisions. The central banks might be forced to hike interest if the prices of basic goods increase at an alarming rate to cure the inflation dilemma.

Statistics of employment in the U.S. and the U.K. are also key considerations while trading the pair. The data paints a clear picture of the health of the economy, which consequently influences traders’ and institutions’ sentiments. Furthermore, the employment data influence central banks’ actions, affecting GBPUSD price action.

Retail Sales Data, Purchases Manager Index, and GDP are other important economic data worth watching while analyzing or looking to trade the GBPUSD pair.

Geopolitical Events

Geopolitical uncertainties such as war drive traders away from riskier currencies such as the pound into the dollar. The dollar acts as a global reserve currency and thus strengthens during uncertain times. Amid the dollar strength, the GBPUSD exchange rate tends to fluctuate significantly.

Brexit

In the recent past, the U.K. decision to leave the European Union emerged as a significant factor swaying trader sentiments on the pound and, thus, the GBPUSD. Any negative outcome or development in the Brexit negotiations with the European Union has often had a negative impact on the pound, causing its value to depreciate significantly against the dollar.

How to Trade the GBPUSD?

GBPUSD, one of the major currency pairs, gives rise to unique trading opportunities that any trader can take advantage of using normal trading strategies. While the pair is liquid and volatile, traders leverage scalping strategies to squeeze profits by taking advantage of small price movements. Consequently, GBPUSD is one of the best pairs for day trading.

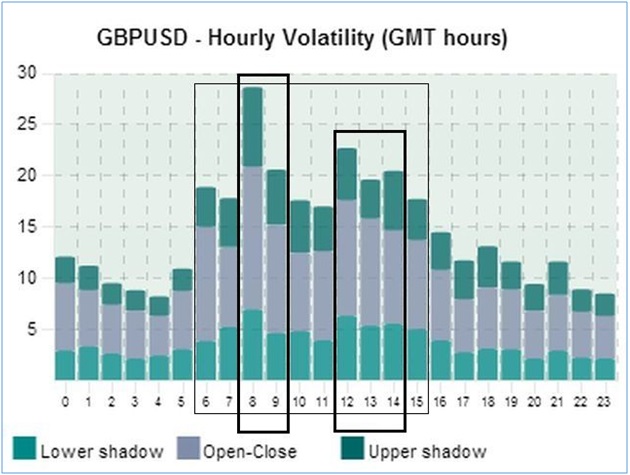

Timing is another important aspect to consider while trading the GBPUSD pair. Just because the forex market is open 24 hours, five days a week does not mean one should trade the pair every time. However, there are specific times when it is most active, giving rise to highly potential trading opportunities.

GBPUSD is volatile and liquid whenever the financial markets in London are open. During this time, banks that play an active role in fueling price action are in operation and sway activities in the market. Therefore, one of the best daily trade GBPUSD is between 0800 and 1000 hours GMT.

Source: Thebalance.com

Additionally, between 1200 hours and 1500 hours, GBPUSD tends to experience an influx in trading orders as the London trading session overlaps the New York session. During this period, there are more market participants and data. As a result, traders experience some of the largest daily moves with low spreads during this period.

Trading the news also offers exciting opportunities to profit from wild swings that come into play. For example, the readily available economic releases and other financial news from the U.K. and the U.S. influence traders’ sentiments on the pound and the dollar, consequently impacting the exchange rate significantly.

Economic reports in manufacturing, employment, and consumer market are some that one can watch closely as they influence traders’ sentiments, giving rise to unique opportunities depending on how the big market participants interpret them.

GBPUSD breakouts also lead to profitable trading opportunities if a trader can get in early in the game. The pair is not always trending. There come periods of consolidation whereby large institutions accumulate positions pending sharp price movements on either side.

Whenever the price oscillates in a tight range, failing to make any new highs or lows, one should wait for a sharp movement once it breaks out of the range. Aligning a trade or position in the direction of the breakouts presents a unique opportunity to make a significant amount of money.

XAUUSD Analysis

In addition to currency pairs, gold also offers high liquidity and excellent trading opportunities in the forex market. Moreover, the precious metal’s fine state and unique position within the global economy and political system makes it an attractive financial instrument.

It is one of the most traded commodities, given the readily available tools and data for speculating its price. Additionally, the metal offers an exciting opportunity to diversify trading or investing practices away from currency pairs.

While the metal is pegged on the U.S. dollar, its price in the forex market is highly dependent on the strength of the U.S. dollar. Whenever the dollar strengthens, the value of the precious metal tends to decline as traders flock to the dollar. Likewise, whenever the U.S. dollar is under pressure, the value of gold tends to appreciate significantly, resulting in significant price swings in the forex charts.

What Moves Gold Prices

Central Banks

The actions taken by central banks during different economic cycles have a significant impact on the price of gold in the market. For instance, whenever an economy is booming and a country has significant foreign exchange reserves, there is always the temptation to reduce the amount of gold the country holds.

Central banks tend to reduce their gold reserves when the economy is booming, and not many people are interested, resulting in a glut in supply. Given the limited demand, the price of gold tends to drop.

Central banks also tend to buy gold in bulk whenever they anticipate volatility in certain currencies, a development that fuels demand, resulting in the value of the precious metal appreciating.

Gold the Safe Haven

The precious metal, like the U.S. dollar, also doubles as a safe haven. The precious metal attracts high demand during periods of uncertainty or geopolitical tensions. Whenever the stock and other financial markets are under pressure, investors tend to flock to the precious metal to safeguard their wealth, given its safe-haven credentials. The high demand often causes the price of gold to increase significantly.

Monetary Policies

Monetary policies by some central banks also tend to impact gold’s value in the forex market. For instance, whenever the U.S. Federal Reserve hikes interest rates, the dollar tends to strengthen, resulting in the value of gold tanking as traders buy the U.S. dollar at the expense of the precious metal.

Source: Investopedia.com

Similarly, whenever the FED cuts interests owing to concerns about the health of the U.S. economy, investors and traders turn to gold and invest in it as a hedge against economic uncertainties.

Geopolitical uncertainties

Gold has always served as a reliable store of value, given its finite nature and the fact that it’s accepted worldwide. Consequently, investors invest in gold to store and protect their wealth from riskier fiat currencies whenever there are geopolitical tensions or uncertainties.

Therefore, whenever tensions escalate between the U.S. and China or Russia, the fear in the financial markets often results in many investments being directed toward the precious metal.

Demand Dynamics

Like any commodity, demand plays a vital role in dictating gold prices in the forex market. As a result, China and India, the biggest consumers of precious metals, have a huge say in the direction XAUUSD will trade.

For starters, whenever there is strong demand for gold for use in jewelry in India, gold prices tend to increase significantly, given the limited supply. Likewise, whenever demand is muted, its prices come under pressure.

XAUUSD Trading Tips

While trading XAUUSD in the forex market, there are a number of factors that one should always keep in mind. Whereas one can trade gold 24 hours a day, peak liquidity which gives rise to highly potential trading opportunities, crop up during the New York trading session. Therefore, it would be wise to target trades during this session as the prospects of orders getting filled quickly is high than during the Tokyo session.

While gold tends to trade in range most of the time, it is best practice to target the highs and lows for buy and sell opportunities. For starters, one can look to enter a buy position once prices pull back to the previous low or open sell positions once the price rises to the previous high.

Source: Colibritrader.com

Given that gold is a stable asset, it always oscillates between highs and lows, providing unique range trading opportunities. Nevertheless, it is essential to also be on the lookout for breakouts. Once in a while, XAUUSD registers sharp price movements as traders react to various developments in the financial markets.

Additionally, it is essential to look for geopolitical or economic implications that pile pressure on currency pairs. Gold emerges as a safe haven for safeguarding wealth whenever currency pairs are under pressure.

In addition, it is essential to track industrial and commercial demand for precious metals due to the fixed global supply. Therefore, the prospects of a gold price increase are usually high whenever demand increases significantly.

Bottom Line

EURUSD, GBPUSD, and XAUUSD are some of the most traded financial instruments as they are highly liquid. The pairs give rise to unique trading opportunities given the readily available data that influence traders’ sentiments. Additionally, they play a pivotal role in the global economy, thus attracting interest from some of the biggest financial institutions.